Reliance Group mulls World’s biggest data center

India’s richest man Mukesh Ambani set to make a grand entry into the AI space to cash in on the emerging tech sector. As per a Bloomberg report, the billionaire industrialist is planning to set up world’s largest data centre in India. The Reliance Group is reportedly buying Nvidia ‘s powerful AI semiconductors to set up its own data centre at Guajarat’s Jamnagar. US-based NVIDIA, a global leader in AI technology, is collaborating with Reliance on an ambitious project targeting a capacity of three gigawatts for its upcoming data center. Once operational, this facility will outsize the world’s largest existing data centers, which currently operate at capacities below one gigawatt, marking a significant leap in infrastructure scale and capabilities. India’s richest man Mukesh Ambani is planning to make a grand entry into the AI space to cash in on the emerging tech sector. As per a Bloomberg report, the billionaire industrialist is planning to set up world’s largest data centre in India. The Reliance Group is reportedly buying Nvidia ‘s powerful AI semiconductors to set up its own data centre at Guajarat’s Jamnagar. US-based NVIDIA, a global leader in AI technology, is collaborating with Reliance on an ambitious project targeting a capacity of three gigawatts for its upcoming data center. Once operational, this facility will outsize the world’s largest existing data centers, which currently operate at capacities below one gigawatt, marking a significant leap in infrastructure scale and capabilities.

8th Pay Commission for central government employees approved by Cabinet

The Union Cabinet on Thursday approved to set up 8th Pay Commission to revise salaries of central government employees and allowances of pensioners. The decision to set up the 8th Pay Commission was taken at a meeting of the Cabinet chaired by Prime Minister Narendra Modi, Union minister Ashwini Vaishnaw said. The minister informed that the chairman and two members of the Commission will be appointed soon. Consultations will also be held with central and state governments and other stakeholders, the minister added.

Centralized System in EPFO: Withdraw Your Pension From Any Bank

With the completion of the Centralized Pension Payments System (CPPS) implementation in all of its regional offices nationwide, the retirement fund organization EPFO will now benefit more than 68 lakh pensioners, the labor ministry announced on Friday. According to a statement from the ministry, the CPPS represents a paradigm shift from the current decentralized pension disbursement system, in which each zonal or regional office of EPFO maintains independent arrangements with just three to four banks. Pension Can be Withdrawn from any Bank According to the statement, a beneficiary under the CPPS will be able to withdraw their pension from any bank; verification at the bank will not be required at the time of pension commencement, and the amount will be credited right away upon release. Starting in January 2025, the CPPS system would also guarantee pension payments across India without requiring the transfer of pension payment orders (PPO) from one office to another, even if the retiree relocates or switches banks or branches, as per the official statement. This will provide significant relief to pensioners who return to their hometowns after retirement. Successful Trial of New Pension System According to a ministry statement, the first CPPS pilot was conducted in October last year at the Karnal, Jammu, and Srinagar regional offices, disbursing around ₹11 crore to over 49,000 EPS pensioners. According to the statement, the second pilot was implemented in November in 24 regional offices, disbursing around ₹213 crore in pensions to over 9.3 lakh pensioners.

SEBI kicks off optional T+0 settlement for top 500 stocks; permits brokers to charge different rates

Indian stock market regulator, the Securities and Exchanges Board of India (SEBI), announced that the optional T+0 settlement will now be available to the top 500 stocks, according to an official circular released on Tuesday, December 10. According to the circular, this announcement will be applicable from January 31, 2025. “Optional T+0 settlement cycle shall be made available to top 500 scrips in terms of market capitalization as on December 31, 2024,” said SEBI. The regulator also said that the option will be first rolled out for the bottom 100 companies of the total 500 list and the entire availability will be rolled out in intervals of 100. “The scrips shall be made available for trading and settlement starting with scrips at bottom 100 companies out of the aforesaid 500 companies and gradually include the next bottom 100 companies every month till top 500 companies are available for trading in optional T+0 settlement cycle,” said SEBI in its official statement. There are, in total, 25 stocks which already fall under the optional T+0 settlement cycle, and these upcoming 500 stocks will be an addition to the existing ones, as per the circular. The market regulator also allowed all stock brokers to participate in the optional T+0 settlement cycle. Within the regulatory limit, stock brokers are now permitted to charge differential brokerage for T+0 and T+1 settlement cycles, effective from January 31, 2025.

Cabinet Approves PAN 2.0: How it will work?

The Union Cabinet has given green signal to the PAN 2.0 Project, a significant upgrade to the existing Permanent Account Number (PAN) system, aiming to improve taxpayer services and streamline business operation. What is PAN 2.0? PAN 2.0 is an advanced version of the current PAN system, using technology to make registration easier and more accessible for taxpayers. The project, with a budget of ₹ 1,435 crore, will revamp the digital infrastructure of the Income Tax Department to provide a seamless experience for individuals and businesses. Features of PAN 2.0 PAN cards will now feature an embedded QR code for enhanced functionality and security. PAN will be a universal identifier for businesses across specified government digital systems. The project will re-engineer taxpayer registration processes and consolidate PAN/TAN services into a unified platform. The project focuses on being eco-friendly, cost-efficient, secure, and fast. Benefits for users Taxpayer registration services will become faster and more user-friendly. Existing PAN holders can upgrade to PAN 2.0 at no additional cost. A unified system will improve service delivery and ensure data consistency. Do I need to apply for a new PAN card? No, you need not apply for a new PAN card. Under the PAN 2.0 initiative, your existing PAN card will remain valid, and the upgrades, including the QR code feature, will be made available without any action from current cardholders. Importance for businesses By making PAN a common identifier, the project aligns with the government’s Digital India vision. Businesses can leverage this universal identifier to streamline interactions with government agencies, ensuring smoother compliance and operations.

RBI Report: Internationalisation Of UPI Progressing Rapidly

The internationalisation of the unified payments interface (UPI) is progressing rapidly, as India emerges as a world leader in leveraging digital technologies for transformative change, according to a Reserve Bank of India (RBI) report. The UPI hit a milestone of 16.6 billion transactions in a month in October, with improvements in its capabilities like successful instant debit reversals at 86 per cent (77 per cent in the same month last year). “India’s UPI, an open-ended system that powers multiple bank accounts into a single mobile application of any participating bank, is propelling inter-bank peer-to-peer and person-to-merchant transactions seamlessly,” said RBI Deputy Governor Michael Debabrata Patra in the report.

Amendment in AIFs Rules by SEBI

Market regulator Securities and Exchange Board of India (SEBI) has made amendments to the rules governing Alternative Investment Funds (AIFs), particularly focusing on ensuring fair and proportional treatment of investors in terms of their rights related to investments and the distribution of proceeds. An AIF is a privately pooled investment vehicle, which means it is a fund that collects capital from a group of investors and invests that capital under a specific investment strategy. The goal is to generate returns for the benefit of its investors. These funds are typically less regulated than public funds and can involve complex investment strategies. They are similar to Mutual Funds, but these private funds do not come under the jurisdiction of any regulatory agency in India, as per the SEBI website.

Gold prices reaches record high

Gold price continued its upward trajectory on October 22 as it hovered around record high hit in the last trading session amid uncertainties over US election, growing tensions in the Middle East and expectations of central banks cutting interest rates. Reuters reported that spot gold rose 0.6 percent to $2,735.14 per ounce by 0658 GMT and US gold futures rose 0.4 percent to $2,749.3. On October 21, the yellow metal, which is considered a hedge against political and geopolitical uncertainty, hit its all-time high of $2,740.37 and has gained over 32 percent so far this year. “A confluence of tailwinds remains in place (for gold), which includes its status as an attractive hedge against U.S. election uncertainties and geopolitical risks, resilient central banks’ demand and room for catch-up ETF buying,” IG market strategist Yeap Jun Rong said. “Buyers may seem to eye the $2,800 level next, as political uncertainties will persist as the election draws nearer”

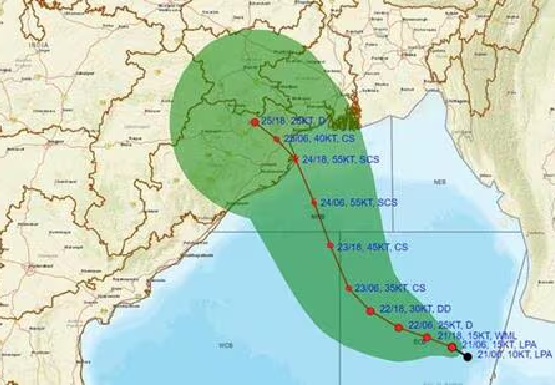

WB, Odisha on alert: ‘Dana’ to make landfall as severe cyclone

Severe cyclone Dana is expected to cross north Odisha and West Bengal coasts between Puri and Sagar Island on the intervening night of October 24 and October 25 at a wind speed of 100-110 kmph, gusting to 120 kmph, the India Meteorological Department has warned on Monday. It is very likely to move west-northwestwards and intensify into a depression by Tuesday morning and into a cyclonic storm by Wednesday over east-central Bay of Bengal. Thereafter, it is very likely to move northwestwards and reach northwest Bay of Bengal off Odisha-West Bengal coasts by Thursday morning. Continuing to move northwestwards, it is very likely to “cross north Odisha and West Bengal coasts between Puri and Sagar Island during the night of October 24 and early morning on Friday as a severe cyclonic storm with a wind speed of 100-110 kmph, gusting to 120 kmph”, the IMD said.

Omar Abdullah sworn in as new CM of J&K

Omar Abdullah, Vice President of National Conference (NC) was sworn in as new Chief Minister of Jammu & Kashmir and Surinder Kumar Choudhary, as Deputy Chief Minister (DCM) during a swearing-in ceremony presided over by J&K Lieutenant Governor Manoj Sinha in Srinagar on Wednesday. In his first comments after taking oath, the Chief Minister said, “We will not let Jammu feel that they do not have a voice or representation in the current government. We have brought in a Deputy CM to ensure this and this will be our endeavour going forth as well.” Prime Minister Narendra Modi congratulated Omar on being sworn in as J&K CM and said the Centre will work closely with him and his team for JK’s progress.